Switch to the mobile version of this page.

Vermont's Independent Voice

- News

- Arts+Culture

- Home+Design

- Food

- Cannabis

- Music

- On Screen

- Events

- Jobs

- Obituaries

- Classifieds

- Personals

Browse News

Departments

-

Education

Scott Official Pushes Back on Former State…

-

News

Burlington Budget Deficit Balloons to $13.1 Million

-

Education

Senate Committee Votes 3-2 to Recommend Saunders…

- Court Rejects Roxbury's Request to Block School Budget Vote Education 0

- Norwich University Names New President Education 0

- Media Note: Mitch Wertlieb Named Host of 'Vermont This Week' Health Care 0

Browse Arts + Culture

View All

local resources

Browse Food + Drink

View All

Browse Cannabis

View All

-

Culture

'Cannasations' Podcaster Kris Brown Aims to 'Humanize'…

-

True 802

A Burlington Cannabis Shop Plans to Host…

-

Business

Judge Tosses Burlington Cannabiz Owner's Lawsuit

-

Health + Fitness

Vermont's Cannabis Nurse Hotline Answers Health Questions…

-

Business

Waterbury Couple Buy Rare Vermont Cannabis License

Browse Music

View All

Browse On Screen

Browse Events

Browse Classifieds

Browse Personals

-

If you're looking for "I Spys," dating or LTRs, this is your scene.

View Profiles

Special Reports

Pubs+More

Renters' Prison: How a Merciless Market of Unchecked Rent Hikes Traps Vermont Tenants

Locked Out Series, Part 7

Published July 6, 2022 at 10:00 a.m. | Updated December 6, 2022 at 8:12 p.m.

The single-family house in Essex Junction was a portrait of the stability that Lisa Scavone and Dean Fraser had been trying to attain. Nestled in a suburban neighborhood, the two-bedroom home on Spruce Lane appears bigger than its 1,850 square feet, with a wide brick fireplace, vaulted ceilings and a finished basement.

When they began renting the house in October 2020, the couple saw it as a crucial stepping-stone for their budding family. Fraser, who is employed remotely in commercial construction, could take calls during the day without disrupting Scavone as the pediatric nurse slept before her overnight shifts at University of Vermont Medical Center. They filled the airy living room with toys for Fraser's 6-year-old son and the family's dog.

Scavone and Fraser paid $2,350 in monthly rent to UVM associate professor Tiffany Hutchins, who owns half a dozen rentals in the area. "When we moved," Scavone said, "we told her we're looking to be here for like five years, and then build a place or buy a place." Last year, Fraser's son started kindergarten in the Essex Westford School District.

About this Series

Seven Days is examining Vermont's housing crisis — and what can be done about it — in our Locked Out series this year. Send tips to

[email protected].

These stories are supported by a grant from the nonprofit Journalism Funding Partners, which leverages philanthropy and fundraising to boost local reporting. For more information, visit jfp-local.org.

Last summer, citing Vermont's "critical shortage of rental units" and "spiking home values" and costs, Hutchins increased the rent by nearly 11 percent, to $2,600, effective on January 1, 2022. Scavone and Fraser, with a combined income over $100,000, weren't happy about the extra $3,000 in annual costs, but they could absorb it. They sought to lock in the elevated rent for a yearlong lease. Hutchins, however, began sending them links to listings of nearby homes that were going for even higher rents. One such "comp," or comparable, was a split-level near GlobalFoundries with mint-colored walls. Its owners had purchased it in 2019 for $286,500; the house was listed for $3,300 per month. "I think it is time to reassess," Hutchins wrote in an email to Scavone and Fraser.

The landlord decided to "test the market." On March 24, she posted the Spruce Lane house to the listing website Zillow for $3,600 per month, utilities not included. Within hours, she said, she had a rush of inquiries. Later that day, Hutchins asked Scavone and Fraser to make time for showings for prospective new tenants. Hutchins also said she would not be renewing their month-to-month lease come June. The date was just a few weeks after their planned May 6 wedding in Scavone's native Chicago.

"I know this news will be disappointing," she wrote. "I very much hope you understand and will work with me to make this a successful transition."

The notice thrust Scavone and Fraser into the worst housing market for Vermont renters in a generation. As their wedding approached, they had to squeeze in time to attend showings, only to find a line of people already there. They'd sit for virtual interviews with property managers and send introduction letters to help their applications stand out, an exercise Scavone said felt "insane."

Renting is typically seen as a ladder to homeownership and personal wealth. But a minuscule supply of apartments and fast-rising prices in Vermont has stranded many renters in a limbo of subsistence and uncertainty while raising the risk of homelessness for countless others at lower rungs of the pay scale. Even middle-class earners face steep rent hikes that have chewed into pandemic-era wage gains and set back their hopes to buy a home, further accelerating the rent spiral.

While high rents have long plagued Vermont, the current situation has become critical. The state had the lowest rental vacancy rate in the country during the first quarter of 2022, according to U.S. Census Bureau estimates: 2.5 percent, less than half of the national average. Conditions in the state's largest rental market, in Chittenden County, are still more extreme. A June market survey by Allen, Brooks & Minor, a South Burlington real estate appraisal and analytics firm, estimated a rental vacancy rate of 0.4 percent. That's the lowest level in 21 years, principal Brad Minor said. It means that in a county of more than 160,000 people, only about 100 rental units are unoccupied at any given time.

Looking for housing?

Are you having trouble finding affordable housing? Check out Seven Days' Vermont Housing Resources Guide, which lists public and private organizations that help qualifying Vermonters find shelter and rent, purchase and maintain homes.

"There are so many people who are in extremely desperate situations," said Jessica Hyman, associate director for housing advocacy programs at the Champlain Valley Office of Economic Opportunity, which runs a statewide hotline for tenants.

The governor and state legislators have pumped coronavirus relief funds into housing production and steered millions in emergency aid to landlords whose tenants lost their jobs and couldn't pay rent. They have not pursued regulations such as rent control that would lend protections to tenants, and Gov. Phil Scott blocked a municipal measure to shield Burlington renters from displacement.

That Scavone and Fraser, who together earn a six-figure income, could be priced out of their home only underscores the reach of the crisis.

"When we follow the rules and pay the rent and do everything," Fraser said, "you expect to have some sort of security of when you need to move."

As their deadline to vacate approached, Fraser and Scavone decided to stay put at Spruce Lane until they found a new place that met their needs, however long that took. If the landlord wanted them out sooner, she'd need to come with a judge's order.

'Feeding frenzy'

The frantic state of the rental market doesn't just mean crowded showings. Minor, the real estate analyst, hears stories from landlords and property managers that mirror the no-holds-barred battles among pandemic home buyers. Some tenants have sparked bidding wars or placed deposits on multiple apartments to ensure that they get one.

"It's like a feeding frenzy," Minor said.

A confluence of factors linked to the pandemic has caused demand for rental housing to outstrip supply, mirroring a nationwide trend of 10 to 30 percent rate hikes in dozens of metro areas since COVID-19 struck, according to research estimates published by the Washington Post. Despite some recent progress, Vermont has not built enough new housing. At the same time, urban flight and the rise of remote work have added to demand. Emergency rental assistance and a now-expired eviction moratorium aided people who might otherwise have been rendered homeless, driving the vacancy rate down, Minor said.

Rents in Chittenden County began to accelerate somewhat last year, Minor's analysis found. He expects that the trend is intensifying in 2022, though no good data yet exist.

"Anecdotally, rents are being bumped by quite a bit more now," he said.

The hot market is affecting apartments that previously have been affordable for renters with modest incomes. In recent weeks, tenants at Little Eagle Bay, an older complex of 72 two-bedroom townhouses in Burlington's New North End, began receiving notices of substantial rent increases. Copies of the new lease documents provided by a few current tenants showed hikes as high as $475 per month, pushing rents from $1,425 to $1,900.

"When I first saw this, I was so furious," one longtime resident said. "I had a week and a half to decide whether to accept a 36 percent increase." The resident, who decided to move out but hasn't yet, requested anonymity for fear that the landlord would retaliate for being publicly criticized.

Little Eagle Bay is owned by an entity registered to Patricia Preseault and managed by PDM, which she owns with a family member, Holly Hammond. Hammond would not provide specific information about the size of rent increases across Little Eagle Bay, citing "respect" for "tenant privacy." In a statement, she said hikes were necessary to offset the costs of insulation and window replacements as well as rising maintenance expenses, including a 69 percent increase in the lawn mowing bill.

Hammond also said property taxes have gone up more than 30 percent over the past five years. That would amount to about $60 per unit each month, Seven Days calculated, if the tax hike were borne solely by tenants.

"In sum, the rent increases are unavoidable due to the exorbitant costs of running this business," she said.

Historically low vacancy rates give property owners extraordinary power to push rents upward as they see fit, with no obligation to demonstrate that the prices they charge align with actual business costs.

Each year, the U.S. Department of Housing and Urban Development estimates the cost of a moderately priced dwelling unit in communities, known as the Fair Market Rent, to set eligibility limits for its low-income housing programs. The 2022 rates for the Burlington metro area were $1,500 for a two-bedroom unit and $1,163 for a one-bedroom.

Today's apartment seekers are more likely to encounter much higher prices, recent listings in Chittenden County show.

Bissonette Properties offered a pair of one-bedroom units in Burlington for $1,500 and $1,600, and a three-bedroom apartment for $3,000. In Winooski, Five Seasons Property Management listed a one-bedroom apartment in a house for $1,350, and Redstone had two-bedroom apartments available for $1,980. Farrell Properties offered all-inclusive rents between $1,700 and $2,000 for studios at its new Cambrian Rise development on the former Burlington College property. A Craigslist posting for a Bove Brothers Realty apartment building along downtown Burlington's Pearl Street asked for $1,325 for a one-bedroom unit.

Notice to vacate

On June 6, a trio of plain white apartment houses in Burlington's Old East End sold for $1.51 million. Tenants in the eight-unit complex on Chase Street got an email from their landlord informing them of the sale and explaining that the buyer wanted to tour their apartments the following day.

Surprised by the news, Caleb Breer drove back from Barre, where he was visiting family, to greet the new landlord.

"I thought I was coming to meet him and be like, 'Hey, I'm one of your tenants,'" said Breer, who lives there with his two teens. "He just wanted to go through my place, see what he wanted to fix and then tell me that I'm being evicted while he was standing in my apartment."

Now Breer and his neighbors have until mid-October to find somewhere else to live.

Like other residential properties in Vermont, rentals were swept up by a spree of sales during the pandemic. Landlords with older buildings cashed out at premium sale prices, while buyers leveraged their assets to get a piece of Vermont's lucrative investment properties. Renters are being displaced as a result, either because their leases are not being renewed or they cannot afford the dramatic rent hikes that often follow.

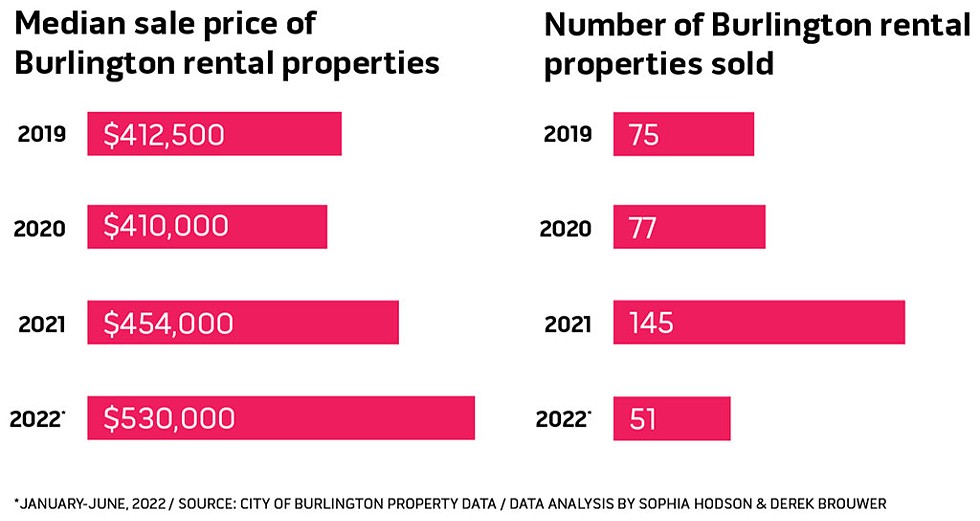

Chittenden County had a "banner year" in 2021 for apartment sales, analyst Minor said, though he would not publicly share the data he's collected because he sells it to industry players. Seven Days' analysis of Burlington property records found that sales of registered rentals nearly doubled last year, while the median sale price jumped more than 10 percent. Sale prices further accelerated during the first six months of 2022, the data indicate.

For one of Breer's neighbors, the sale could lead to a financial crisis. Erika, who asked that her full name be withheld out of concern that her comments would affect her housing search, has been paying $575 per month for a room in one of the Chase Street buildings. The 31-year-old member of Burlington's LGBTQ community works full time as a youth coach at Spectrum Youth & Family Services, where she helps teens who are homeless — as she once was — look for permanent housing. She can only afford an apartment that costs up to $800 per month, which will be very difficult to find. Research has shown that LGBTQ people face markedly higher rates of homelessness, and that's where Erika fears she could be headed again.

"There's a good chance that I am going to end up accessing the same types of homeless services and transitional housing programs that I work in," Erika said. "That's a really terrifying thought. It's keep-you-up-at-night kind of stuff."

Across the Winooski River, Wylie Dulmage and his girlfriend are in the process of relocating after the Onion City duplex they lived in went under contract in June. Dulmage, head bike mechanic for the nonprofit Local Motion, said they saw the writing on the wall at showings crowded with prospective buyers. They began aggressively applying for new apartments even before their notice to vacate arrived and managed to secure a two-bedroom in Burlington through Bissonette Properties. Their rent will be $2,100 — far higher than the $1,350 they have been paying. Dulmage's ability to increase his income is limited; he already has a side hustle running a mobile bike repair.

"It's going to be a much more stoic existence," Dulmage said.

Michael Luisi is among those who have purchased apartment houses in Burlington. The 33-year-old works a day job in IT and, over the last few years, has started investing in fixer-upper rentals as a retirement plan. Luisi has teamed up with friends to buy the properties, some of which were marketed with room to boost rents as a selling point. After making updates to a fourplex on North Willard Street, which he and his partners bought for $545,000 in February, he listed a 375-square-foot studio for $1,875 per month.

Luisi said the inflated prices are necessary to cover the mortgage for his sky-high purchase price, plus the improvements he makes. The maintenance needs are substantial: Luisi said he's logged more than 500 hours of work on the homes so far this year and has documented them in thousands of photos at every stage of the process.

Luisi also allowed Seven Days to review copies of his bills for the North Willard property supporting his claim that he needed to charge $1,700 per unit to remain cash-flow neutral and generate enough revenue to cover repairs. Luisi said he's shown the same information to some of his tenants. "If you're going to do a rent increase or you're going to charge a higher rate, at least show them why," he said.

Still, Luisi acknowledged that market rents in Chittenden County far exceed local wages. He's also frustrated that some other landlords, who bought their properties years before him for far less and do little to maintain them, are charging similarly high rents.

"There's absolutely some cases of price gouging going on," he said. "The ones I rent, I do personally think they're overpriced, but the prices reflect what I need to actually make to break even on the property and to meet the bank requirements."

Luisi acknowledged that his investment strategy has displaced tenants who couldn't afford the new rents. In at least one case, he paid a moving stipend to an affected tenant, according to a Venmo receipt he provided. He has been flexible on move-out timelines.

After Luisi and his partners bought a four-unit apartment building on Intervale Avenue earlier this year, the seller called Katie Stahl, a tenant there, to tell her the new landlord would be doubling the monthly rent on her tiny studio, from $875 to $1,750. "I was speechless — absolutely in shock," the 26-year-old mortgage lender employee said. "There's no way in hell I can afford $1,750."

Stahl found a $1,190 studio with help from family and coworkers, but her family will have to subsidize her rent for the time being.

"I think about those people who aren't in a situation as privileged or as lucky as I am," she said, "and I feel terrible."

One of Luisi's properties, a Pine Street apartment house he purchased last year for $401,000, is back on the market. Asking price: $665,000.

Chronic condition

click to enlarge

- Daria Bishop

- Tenant Wylie Dulmage moving out of his apartment on Maple Street in Winooski

Last year, Burlington voters endorsed a change to the city's charter that would have protected many of the renters now being displaced from their homes. The proposal would have limited evictions to situations in which a landlord can prove "just cause," such as nonpayment of rent or other violations of a lease. Crucially, the charter change would have also barred "unreasonable" rent increases that could be used as de facto evictions or lease nonrenewals.

The Just Cause Coalition promoted the policy as important for neighborhoods with few vacancies and escalating rents, "where landlords may seek to evict existing tenants to renovate their buildings and attract wealthier renters at higher prices."

Nearly two-thirds of city voters said yes to the change, despite vocal opposition from landlords, including Hammond at Little Eagle Bay. But under Vermont law, municipal charter changes also require state legislation. Republican Gov. Scott vetoed the measure, arguing that by making it more difficult for landlords to remove tenants, the charter change would instead "discourage property owners from renting to vulnerable prospective tenants, or to rent their units at all." House lawmakers failed to override his veto by a single vote.

While most municipal and state leaders now support efforts to add or rehabilitate rental housing, they've done very little to protect tenants from the extreme market forces that currently exist. A proposal to create a basic registry of rental units across the state was scrapped over a veto threat from Scott, who has taken a position that any red tape — in this case, a $35 annual fee — would exacerbate the rental shortage.

Many of the renters interviewed for this story wondered aloud why Vermont doesn't have rules barring sudden large rent increases, as some major cities do. For the past two legislative sessions, Rep. Curt McCormack (D-Burlington) introduced a bill that would have enabled municipalities to enact such rent control ordinances. McCormack, who is not running for reelection, said out-of-control prices are crushing tenants in his city, where the majority of residents are renters.

His bill never got a hearing.

McCormack knows the challenges of being a landlord. He lives in a fourplex and rents out the other three units. In fact, he raised rents 5 percent this year to offset a 22 percent property tax hike. His two- and three-bedroom apartments now rent for just $1,100 to $1,275 per month, he said — well below market rates.

"Your housing should be affordable, just like we have national policies on food," he said. "We don't let basic food get too expensive."

Today's crisis is an iteration of a problem that has been recurring for decades. In an interview, longtime Burlington Progressive Brian Pine, director of the city's Community & Economic Development Office, quoted from a City of Burlington annual report that summarizes the present situation plainly.

"Rampant real estate speculation," the report stated, "is contributing to gentrification and attendant displacement, destabilization of neighborhoods, and the loss of affordable housing."

The report is from 1986.

During that earlier crisis, Burlington voters approved a different charter change that attempted to curtail investor speculation in apartment buildings by imposing a special tax on such sales. The state legislature quashed that.

But other tenant-protection efforts undertaken during the Bernie Sanders mayoral era succeeded. They included a city ordinance that requires property owners who want to convert their apartments into condos to offer tenants a chance to purchase them or cover some of their relocation expenses.

In addition to gaining those policy reforms, residents organized. With the help of professional advocates and sympathetic elected leaders, tenants at Northgate Apartments were able to take ownership of the 336-unit property in the New North End and preserve its status as affordable housing. More than 30 years later, Northgate remains the largest affordable rental complex in Vermont.

Pine, who went door-to-door with Northgate residents at the time, believes such nonprofit approaches, known as "social housing," hold more promise for easing housing pressures than the capitalist marketplace.

"The whole notion of rental housing as a form of profit and income — I don't know if we've figured out a way for it to serve both the owner and investor and the people living there," he said.

"It doesn't seem to be very successful," he added.

Rent burdened

A quarter of Vermont renters spend at least half of their income on housing, according to pre-pandemic U.S. Census estimates, a level the federal government considers to be a "severe" burden. Another one in four renters forks over between 30 percent and half of their income, which is still considered onerous.

Renters in the Green Mountains are almost twice as likely to be financially burdened by their housing costs as residents who own their homes.

Research published this year by Harvard University's Joint Center for Housing Studies suggests the "cost-burdened" figures don't fully capture the number of renters who are being pinched, especially those with children. By comparing rent and income against other expenses such as health care and transportation, the researchers calculated that 62 percent of renters nationwide can't afford a comfortable standard of living — 14 percent more than identified by the cost-burden measure.

Low-income people and historically marginalized groups are hit hardest by high rents and low vacancy. They're more likely to be stuck in units that are cramped and substandard or to pay crippling proportions of their income to remain housed.

Vermont and federal law provides housing discrimination protections for certain tenants, such as parents, people of color, LGBTQ renters and those with disabilities. But in a razor-thin market, renters in protected classes can be more vulnerable to subtler discrimination that's disguised by rent hikes or "no cause" terminations.

"In any rental situation, there's a power dynamic at play," CVOEO's Hyman said. "When there's so few units available ... it really exacerbates that power dynamic and tends to have even more of an impact on people who are traditionally discriminated against or excluded from housing."

Vermont law also bars landlords from turning away renters because they get public assistance, but property owners are free to raise rents above federal Section 8 rent-voucher eligibility guidelines.

Just 38 percent of people awarded vouchers last year through the Vermont State Housing Authority found a place to use them — a "historically low" rate, executive director Kathleen Berk said. A recent federally authorized bump in how much VSHA may pay landlords is relieving the problem, she said. But each unit now costs on average an additional $72 monthly, reducing how many renters the agency can assist.

Landlords can easily rent a unit for more to someone who isn't on Section 8, noted Kylie Brown, a family support and housing service coordinator at the nonprofit Family Center of Washington County. One of Brown's clients is a single mother who has been living in a hotel for more than a year because she's been unable to find an apartment, even though she has a voucher. The woman "is doing everything in her power to get housed" while also caring for her three children, Brown said.

"We have a lot of families who are working really hard and being really diligent and who are really stuck right now," she said.

Vermont's smallest city offers an example of how the working class is in danger of being squeezed out. Amanda Mullen moved back to her hometown of Vergennes, population 2,500, with her husband and two young kids in 2019 to be closer to her grandparents. They've been living in a two-bedroom apartment owned by Addison County Community Trust, a nonprofit housing agency, with subsidized rent of around $900 per month. The family has more income now that Mullen has returned to work as a dog trainer, so they've been searching for a place somewhere with an extra bedroom for their growing kids.

The pandemic real estate rush drove homeownership out of reach for the family, and the few unsubsidized rentals that get listed in Vergennes tend to be small units that cost double what Mullen currently pays. "That leaves no room for families," she said.

Many of the market-rate apartments in Vergennes are owned by David Shlansky, president of Burchfield Management. Shlansky specializes in rehabbing old buildings and renting out mostly smaller apartments; he recently offered one-bedrooms units at $1,375 and $1,740 per month. His buildings have increasingly attracted a mix of remote workers and people who commute to jobs outside Addison County, he said.

In March, Mullen vented her mounting frustrations on Front Porch Forum. She wrote that despite Vermonters' concerns about the dwindling number of school-age children, "here we are PUSHING families out with astronomical housing prices, poor wages and landlords making the majority of rentals too small."

If Mullen's family were able to move out of her ACCT apartment, that would also free up her income-based unit for someone else. During the pandemic, rental applications to ACCT doubled, leaving seven or so households vying for every unit that becomes available, according to executive director Elise Shanbacker. The nonprofit is currently building more apartments around the county, including a 20-unit project in Bristol, but the shortage remains severe.

"Anecdotally, the people that I know of who are moving on from our apartments are moving out of county, possibly out of state," she said.

Mullen hasn't given up, but her leads are scarce. As of mid-June, she was preparing an application to Habitat for Humanity, in hopes that her family would be selected for one of its affordable home projects.

No refuge

Vermont's rental housing crisis, like the country's, is a systemic problem. But it plays out unit by unit, where one person's decision has an outsize effect on another person's life. The resulting conflicts can be personal.

In Essex Junction, Hutchins had the right to end Scavone and Fraser's month-to-month lease in order to seek a higher rent. They still felt wronged and were angry that their family's housing situation could be upended so swiftly. Fraser described it as "degrading."

"I'm trying to create stability — we're trying to create stability — for a kid. And, you know, all the things that we were taught to do growing up, it's out the window," he said in June.

Hutchins' attorney filed eviction paperwork in Chittenden Superior Court on June 6, as soon as the date had passed when Fraser and Scavone were told to vacate the carriage home. Eviction proceedings can drag on for months before the county sheriff receives authority to physically remove a tenant from the premises, which Fraser and Scavone were counting on as a way to buy themselves time to find a place to live.

"We didn't really have any other options," Scavone said.

Hutchins had already signed a lease with a new tenant, to whom she was planning to rent the house for $3,400, despite having listed it for more. That tenant, Hutchins said, was counting on her scheduled move-in date, but Scavone and Fraser never moved out.

As the date neared, Hutchins knocked on the front door early one morning, unannounced. She had come to see whether they were packing their things, she said, but Fraser refused to discuss it. Fraser said he asked her to leave because she hadn't notified them that she was coming. He then called the police, who arrived but told him it was not a law enforcement issue.

Hutchins said she never asked Fraser and Scavone to pay the $3,600 rent she had advertised for the house. Following the initial increase to $2,600, she said, Fraser refused to negotiate a second increase in good faith, despite the fact that, in her assessment, the rent they'd been paying was still "woefully under market" and she was planning to renovate the kitchen.

Hutchins claimed that Fraser was trying to ruin her reputation by contacting Seven Days about the situation and told her he planned to make her "famous." Fraser denied saying that.

As for the higher rent: Hutchins said her expenses had gone up, and the same day she'd listed the property, she received distressing news about a family member that compelled her to seek an increase.

"This isn't a story about greed," Hutchins said. She added: "This is what happens when you try to negotiate a rent increase with someone who is unreasonable."

Fraser and Scavone said they were recently able to secure a two-bedroom townhouse in South Burlington for $2,500 per month. Fraser's son will have to change school districts, but the couple said they're happy to have somewhere comfortable to go. "I can't even express the amount of relief that brought, of just being able to just sign a lease," Fraser said.

They plan to continue living at Spruce Lane — where, according to Hutchins, they've stopped paying rent — until their late July move. In the meantime, Hutchins said she lost her new tenant, and her legal expenses are mounting. She said she now plans to rent the two-bedroom house to college students for $2,800 per month. Fraser and Scavone's eviction was still pending as of press time.

Hutchins said the ordeal with Fraser and Scavone has been a "low-level trauma" that, in addition to some other problems with recent tenants, will discourage her from taking unnecessary "risks" in the future.

"I used to rent with people with subpar credit. I used to charge less," she said. "The whole environment feels so much more perilous to me."

Besides the Spruce Lane house, Hutchins and her husband own and personally manage five other rental properties. Hutchins said they got into the landlord business primarily as a long-term investment for their children.

"I'd like my daughters to have an education and a home that's paid for," she said, "so they don't have to worry about this stuff."

Sophia Hodson contributed data analysis.

Seven Days is examining Vermont's housing crisis — and what can be done about it — in our Locked Out series this year. Send tips to [email protected]. These stories are supported by a grant from the nonprofit Journalism Funding Partners, which leverages philanthropy and fundraising to boost local reporting.

Seven Days is examining Vermont's housing crisis — and what can be done about it — in our Locked Out series this year. Send tips to [email protected]. These stories are supported by a grant from the nonprofit Journalism Funding Partners, which leverages philanthropy and fundraising to boost local reporting.

Got something to say?

Send a letter to the editor

and we'll publish your feedback in print!

Tags: Housing Crisis, Locked Out, rental, rental market, rental housing, rent

About The Author

Derek Brouwer

Bio:

Derek Brouwer is a news reporter at Seven Days, focusing on law enforcement and courts. He previously worked at the Missoula Independent, a Montana alt-weekly.

Derek Brouwer is a news reporter at Seven Days, focusing on law enforcement and courts. He previously worked at the Missoula Independent, a Montana alt-weekly.

More By This Author

Latest in Category

Speaking of...

-

Strict Laws Govern Rental Security Deposits. What If a Landlord Ignores Them?

Aug 30, 2023 -

Housing Bills Take Aim at Local Control in Vermont Towns

Jan 16, 2023 -

Sugarbush Resort to Build Worker Housing Near Mountain

Jan 13, 2023 -

Expensive Housing Is Limiting Who Gets to Live Where in Vermont — and Clouds the State's Future

Dec 7, 2022 -

New Programs Aim to Change Vermont’s Dismal BIPOC Homeownership Rates

Nov 30, 2022 - More »

find, follow, fan us: