Switch to the mobile version of this page.

Vermont's Independent Voice

- News

- Arts+Culture

- Home+Design

- Food

- Cannabis

- Music

- On Screen

- Events

- Jobs

- Obituaries

- Classifieds

- Personals

Browse News

Departments

-

Education

Scott Official Pushes Back on Former State…

-

News

Burlington Budget Deficit Balloons to $13.1 Million

-

Education

Senate Committee Votes 3-2 to Recommend Saunders…

- Court Rejects Roxbury's Request to Block School Budget Vote Education 0

- Norwich University Names New President Education 0

- Media Note: Mitch Wertlieb Named Host of 'Vermont This Week' Health Care 0

Browse Arts + Culture

View All

local resources

Browse Food + Drink

View All

Browse Cannabis

View All

-

Culture

'Cannasations' Podcaster Kris Brown Aims to 'Humanize'…

-

True 802

A Burlington Cannabis Shop Plans to Host…

-

Business

Judge Tosses Burlington Cannabiz Owner's Lawsuit

-

Health + Fitness

Vermont's Cannabis Nurse Hotline Answers Health Questions…

-

Business

Waterbury Couple Buy Rare Vermont Cannabis License

Browse Music

View All

Browse On Screen

Browse Events

Browse Classifieds

Browse Personals

-

If you're looking for "I Spys," dating or LTRs, this is your scene.

View Profiles

Special Reports

Pubs+More

Published March 9, 2022 at 10:00 a.m. | Updated December 6, 2022 at 8:05 p.m.

- Diana Bolton

The cottage in Burlington's New North End looked cozy and inviting. It was white with black shutters, and a proverbial picket fence enclosed the backyard. The home, with just 1,428 square feet of living space, was nestled in an unassuming neighborhood built for families to enjoy peacetime after World War II. A small, attached garage, sized for only one vehicle, harked back to a day when Americans got by with less.

Not so modest was the price: $425,000.

The Saratoga Avenue home had last sold nine years earlier, for $260,000. But a cost increase of nearly two-thirds didn't discourage a steady stream of potential home buyers on February 12, a frigid Saturday.

About this Series

Seven Days will examine Vermont's housing crisis — and what can be done about it — in our Locked Out series this year. Send tips to [email protected].

These stories are supported by a grant from the nonprofit Journalism Funding Partners, which leverages philanthropy and fundraising to boost local reporting. For more information, visit jfp-local.org.

Taryn Haas approached the little house optimistically. Haas, who works from home in Barre, and Haas' husband, Garret Blank, an air traffic controller, were searching for a place closer to his workplace at Burlington International Airport. The fenced yard would be ideal for their three dogs. By chance, friends of theirs meet regularly to play board games down the street.

But as they approached the house, Haas overheard another potential buyer strategizing how to make a winning bid. Inside, others touring the place also seemed to like what they saw.

The couple wound up not bidding. Haas figured that their offer would not have been the most appealing, since it would have been contingent on a professional home inspection. Later, an agent said the open house led to multiple offers; within days, the place was under contract for more than the asking price.

The couple quickly pivoted to a new target: a larger home in St. Albans that, in online photos, appealed to them. This time, they bid aggressively: $405,000, more than the $399,900 asking price. They further agreed to boost their offer to beat out any higher bidders by $2,000, up to as much as $450,000, if necessary. They had never even seen the house. They figured they couldn't risk waiting.

They soon got word: no deal. That house, too, went under contract with other buyers.

Haas feels lucky just to be able to bid. The couple is preapproved for enough financing to compete even in this heated market. And they live in a house Haas bought a few years ago, so they have equity, too.

But many others have been locked out of homeownership by the small number of places for sale, rocketing prices and pandemic-related demands for housing in the Green Mountains. Last week, only about 30 homes priced at less than $600,000 were available in Chittenden County, said Andrew Mannix of the Malley Group at KW Vermont. He marveled at how quickly properties were being snatched up.

Stories abound about home buyers bidding higher than the list price, offering cash and waiving commonsense contingencies such as getting a home inspection. Cautious bidders are left out in the cold.

The median sales price of Vermont homes rose by 19 percent in 2020 and 2021, according to the Vermont Housing Finance Agency, which promotes and subsidizes affordable housing. In Caledonia County, prices surged by 35 percent — the highest rate in the state.

Salaries, though, have simply not kept up. In the three decades that ended in 2019, median household incomes in Vermont rose by 108 percent, lagging well behind a 143.3 percent jump in median home prices, VHFA data show. A growing number of Vermonters can't afford a whopping down payment and a hefty mortgage, though they earn too much to be eligible for subsidized housing. For them, the American dream is no longer in reach. They're trapped in the rental market, where prices also have marched relentlessly higher, paralleling real estate costs.

The consequences touch every aspect of life in Vermont. Residents such as Blank commute long distances because they can't find a home near their work. Young adults live with their parents or think about leaving the state. As of last week, 2,361 Vermonters, including 488 children, remained housed in the state's motel program.

Companies have to scramble to find housing for workers. Ski resorts are seeking creative solutions, such as offering free season passes to second-home owners who host their employees.

Vermont houses have sold sight unseen during the pandemic as people migrated from urban areas. The rise of telework and ongoing efforts to extend broadband to the state's most remote hollows make the Green Mountains even more inviting. Climate migrants fleeing coastal storms and western wildfires increasingly view Vermont as a haven.

Real estate agents say many of the incoming out-of-staters have ties to the state or are actually returning Vermonters. Like other home buyers, they have to contend with bidding wars exacerbated by the meager supply of homes.

Reasons for the shortage abound. Vermonters' lifestyles have changed, and fewer people tend to live under one roof these days. The home-building industry in Vermont has languished in recent decades, and fewer homes are being built, stressing the market.

As in much of New England, the state's housing stock has aged; many properties have fallen into disrepair, though they could be renovated — at a cost. Evidence shows that — in Burlington, at least — more houses are being purchased not as primary residences but as investments for short- and long-term rentals.

Elected officials have taken notice, and proposals to help homeless and low-wage Vermonters — and middle-class families — are currently winding their way through legislative committees in Montpelier. State officials are discussing strategies that could speed up regulatory review of housing projects. Vermont is flush with pandemic relief cash that it's obligated to spend quickly.

State government is also trying to help communities update myriad zoning regulations adopted decades ago — regulations that state officials say can hamper home construction. In January, Vermont awarded a total of $500,000 to 23 local efforts to modernize codes to ease the way for the development of compact neighborhoods.

Legislators also plan to help Vermonters design and develop so-called "accessory dwelling units," such as in-law apartments, in underutilized spaces in private homes. Ongoing funding will also target rehabilitation of older homes.

Today's real estate pressures are forcing Vermont, which has long been careful and deliberate about what can be built, to rethink its fundamental approach to housing.

"The No. 1 thing that Vermont needs to wrestle with and be comfortable with is ... pro-housing growth," Josh Hanford, the state's commissioner of housing and community development, told a Senate committee last month. "And we haven't been for decades."

Blueprint for a Shortage

click to enlarge

- Jeb Wallace-Brodeur

- Taryn Haas and Garret Blank with their dog, Pippin, in front of their Barre home

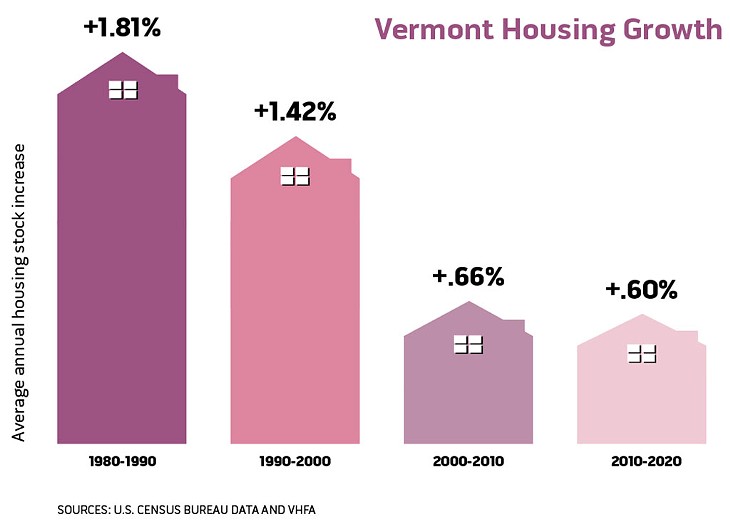

In the 1980s, new houses sprouted more frequently in Vermont.

The supply of occupied primary homes grew on average by 1.8 percent each year. But by the decade that ended in 2020, that had decreased to just 0.6 percent — a third as much — according to housingdata.org, an online resource of the VHFA.

What happened?

Housing-sector professionals blame rising construction costs for the downturn, according to VHFA executive director Maura Collins. Builders cite growing prices for materials and land. They also say the construction workforce has gotten more expensive because it is smaller. And builders further blame a regulatory environment that often involves lengthy local and state approval processes.

Workforce issues have plagued the home-building industry for years, according to Chris Snyder, the president of Snyder Homes in Shelburne. His parents started the business in 1976. He said the firm used to build 55 to 60 homes a year.

Then came the Great Recession in 2007. The dramatic collapse of the market took a lasting toll on the workforce, Snyder said, and many of the people in the building trades sought other occupations. Today, the business is coming back, he said, but it's been "a long, slow slog." Snyder Homes built 28 to 32 homes in each of the past four years.

"So what does that say?" he asked, then answered his own question: "We're doing 50 percent of the work."

Jim Bradley, a builder who is one of the hosts of "House Calls Vermont," a WDEV Radio program about home contracting, said more people are retiring from the trades today than are taking them up — an unsustainable trend.

Graham Mink, a former pro hockey player who builds multiunit buildings in the Morrisville and Stowe area, said the economics don't favor construction of a lot of inexpensive single-family homes.

Part of the problem, he said, is scale: Building more than 10 homes triggers an Act 250 review, and that adds a layer of uncertainty to a project. And the cost of a review, he said, can be the same for building a dozen homes as it is for building 300 — which can discourage smaller-scale developers. Building a $2 million house in Stowe for wealthy out-of-staters — a project that wouldn't require state review — amounts to less of a risk than building multiple inexpensive houses.

To build anything, contractors need land, and the price for buildable lots has been rising "neck and neck" with higher home costs, David Mullin said. He buys parcels as the executive director of Green Mountain Habitat for Humanity, which uses volunteer labor to build affordable homes. Sometimes he's lucky, such as when a volunteer bicycling on Hinesburg Road in South Burlington spotted a man putting up a "For sale" sign. Habitat pounced and got the property, Mullin said.

More recently, Mullin learned about some land in Winooski that had just come on the market. Within hours, he'd offered the full asking price, but it was already too late.

On top of these chronic problems, the pandemic has dramatically increased the cost of materials. Snyder noted that the exterior sheathing boards he uses have tripled in price to more than $75. "They're telling us there's a shortage," he said. "I don't buy it. It shows up at our job site every time we order it."

Home buyers foot the bill.

S.D. Ireland's Aiken Street Flats, a project that was still under construction last month, will offer views of Lake Champlain from condominiums in three-story buildings atop a vantage point in a neighborhood off Spear Street in South Burlington. The "flats" start at $555,000 and run to $700,000, said Patrick O'Brien, the firm's general manager of construction and development. All but one of the 24 homes are under contract.

"Unfortunately, when we were talking about this project a couple of years ago, we thought we would go to market in the [mid-$400,000 range]," he said. But because of rising labor and material costs, as well as permitting-related expenses, which can constitute 20 percent of a project's expense, S.D. Ireland had "no choice," he asserted, but to jack up the home prices.

Backyard Battles

Two Shelburne chiropractors who have proposed a complex of multifamily buildings off Route 7 are experiencing another common factor that thwarts home construction in Vermont: neighborhood opposition.

Tucked away behind their office on busy Route 7 is a six-acre lot — a wooded oasis off the commercial strip that, improbably, has never been developed. Now, Stephen Brandon and his wife, Shelley Crombach, who own the land, have proposed building a community of more than 100 townhomes there.

The project is allowed under the town's form-based code, a type of zoning adopted by Shelburne in 2016 that is meant to fast-track projects that meet preset standards. The town's Development Review Board has approved a sketch plan — essentially, a rough conceptual design. Still, neighbors are unhappy with the size of the development and quickly organized to oppose it.

About a dozen suburban-style single-family homes, including one owned by Nancy and Chris Badami, line the south side of Palmer Court, facing the trees that would be cleared for the project.

"We all realize that this six acres is not going to be a wooded lot forever," Nancy Badami told Seven Days, echoing the sentiments of many neighbors who have spoken publicly. "But the amount of units, and therefore the amount of people and cars and traffic, just seems a little excessive for this neighborhood ... as well as the scale of it." Neighbors would welcome single-family homes, she clarified.

Also fighting the plan are homeowners to the north of the parcel on Wild Rose Circle and others just down the road in the Clearwater neighborhood, which sits on the shore of Lake Champlain and has its own beach. It's served by a private road; a sign warns people who aren't guests that they are not welcome.

The neighbors, under the banner of the newly formed Shelburne Neighbors United for Responsible Growth, have shouldered legal costs together, Badami said. Their attorney, Liam Murphy, has urged the town to temporarily suspend the zoning rules. Neighbors say those who put them in place didn't intend to allow such a compact, dense development in a residential area.

The Badamis penned a document ahead of a February 22 selectboard meeting calling for people to show up and speak out against the project. "As of now, one of our strongest deterrents to the development is our willingness to fight ... and the impeding years it would take them to make any headway," it said.

Indeed, the situation has the potential to become a prolonged conflict. The project would still require review under Act 250, Vermont's land use law, if it received its local permits, according to Ken Belliveau, the town's DRB coordinator.

The Badamis and other neighbors insist that this is not a NIMBY battle and they're fighting to preserve the area's character. Still, that's the argument that often derails housing plans or forces applicants to scale them down, housing advocates say. Brandon and Crombach declined to comment for this story.

Nancy Owens is copresident of Evernorth, a nonprofit that helps provide affordable housing in northern New England. Around Vermont, she said, "There's a real disinterest in having things change." Projects sometimes get sidelined, shrink and become more expensive because of what she politely called "community activity."

"The people who are going to live in the housing, whether it's single-family homes, or luxury housing, or multifamily affordable housing, or just rental market housing, those people are not constituents," she said. "They don't live in the community yet. Or maybe they do. But they're not obvious."

Developers have a healthy respect for Vermonters' ability to challenge projects, and they often pick sites and strategize accordingly.

Burlington landlord Stu McGowan is the guy who bought up and painted dozens of Old North End homes in colors such as hot pink and neon green. These days, he told Seven Days, he's an investor in a housing project outside Chittenden County, one that hasn't become public because no applications have been filed — yet. It involves 500 to 600 units, potentially, and backers are hopeful that the location will not draw organized opposition.

Where is it? McGowan did not want to divulge that information yet, fearing that neighbors might band together to oppose it.

In Shelburne, the power of "community activity" was evident at last month's selectboard meeting. Dozens of neighbors watched while members debated whether to temporarily suspend local zoning rules that would have permitted the chiropractors' project. Brandon listened as neighbors urged elected officials to derail his plan.

Board member Cate Cross defended it. She noted that a small house on her street recently sold for $550,000. Blocking the project, she said, would effectively limit more affordable housing in Shelburne — and access to a neighborhood with good schools along a bus line. ("Affordable housing for families is pretty much nonexistent in Shelburne," she later told Seven Days.)

Vice chair Kate Lalley noted at one point that her daughter, who is almost 30, has a decent job and would love to stay in Vermont but could be pushed out with her fiancé by "the housing issue."

"So, for me, this is an existential issue," she added.

Regardless, Lalley made a motion to hold a public hearing on a bid to temporarily change the zoning. She proposed restricting residential building heights to two stories in the district in question. The chiropractors' plan calls for erecting several three-story buildings. The selectboard approved Lalley's motion 3-2. The public hearing will be held on March 22.

Constructing a Strategy

In his January 18 budget address to the legislature, Gov. Phil Scott said he'd heard from a teacher who'd searched for months for a home. "She reached out to us in frustration because she does not feel we have done enough to help Vermonters like her," Scott said. "And she's right."

Legislators, too, say they are eager to act.

"There is literally no place for people to live," Rep. Seth Bongartz (D-Manchester) said. "If you don't have a house now, you're out of luck."

But how does state government tackle a housing crisis that is driven by national prices, in-migration, a pandemic and inflation?

Vermont's strategy is just part of an effort also under way at federal and local levels, House Speaker Jill Krowinski (D-Burlington) said. But creative solutions are afoot at the state level, such as efforts to draw more young people into careers in home construction, she said.

What if people learning building trades at Vermont's 17 career and technical education centers actually rehabbed blighted buildings in their communities? That's a proposal the House Committee on Commerce and Economic Development has been discussing.

Rep. Michael Marcotte (R-Newport), the committee's chair, said a state fund would finance the purchase of properties. Once they are finished and sold, the money would be reinvested in the fund. More young Vermonters could be attracted to learn the building trades; distressed properties would be restored, and new homes would be available. Loans for those learning the trades — which would be forgiven if they later worked in Vermont — are another strategy being considered.

"You can make a good life for yourself if you get into the trades," Marcotte said.

On Tuesday, Gov. Scott proposed spending $45 million in surplus funds to improve those tech centers statewide. The funding would give trainees the opportunity to work on residential construction projects and would improve classrooms and equipment, he said.

Scott, meanwhile, had previously proposed a program to encourage the construction of modestly priced single-family homes, which, he said, are "practically nonexistent." He's proposed a $15 million pilot to be run by VHFA.

Another proposal would allocate up to $5 million to set up a statewide accessory dwelling unit navigation system that would help homeowners design and pay for developing new living spaces on their properties.

That ADU system is just one of the measures in an omnibus housing bill that the Senate Committee on Economic Development, Housing and General Affairs has been discussing for weeks. The draft bill would appropriate $5 million chunks for various other efforts, including converting commercial properties into housing, improving mobile homes and matching employer funds to house workforces.

Vermont has plenty of resources, thanks to the American Rescue Plan Act and a state surplus. The governor has called for spending $145 million in ARPA funds on housing in the year ahead: $105 million for affordable, mixed-income projects, which the state has long supported; $25 million for the Vermont Housing Improvement Program, which helps landlords upgrade rentals; and the $15 million pilot home construction program.

Also on the table in Montpelier is something that's become an annual legislative ritual: considering updates to Act 250, Vermont's land-use law.

Karen Horn, a lobbyist for the Vermont League of Cities & Towns, calls permitting in Vermont a "Gordian knot." She asked legislators to eliminate Act 250 jurisdiction in municipalities "with robust zoning and development capacity," saying the reviews are redundant, as well as in neighborhood development areas and designated downtowns — places the state has specifically considered and preapproved for growth.

Projects in those areas that include a sufficient number of affordable units can already qualify as priority housing projects — which skirt Act 250 review. Draft Senate bills would ease the rules to allow more projects to qualify but would not eliminate Act 250's jurisdiction in larger areas, as the league requested.

Sen. Chris Bray (D-Addison), who chairs the Senate Committee on Natural Resources and Energy, said he's skeptical of builders' claims that Act 250 is to blame for lengthy project delays and higher costs. Data show, he said, that decisions on projects don't take too long, though he acknowledged that there have been "outliers." For five decades, he said, Act 250 has "kept Vermont Vermont."

Housing Is a Commodity

Diana Carlisle feels a special attachment to the house two doors north of hers on Lakeview Terrace in Burlington. Her parents purchased the property in 1957, when many considered the Old North End street to be on the wrong side of the tracks. The coal-fired Moran Plant on the Lake Champlain waterfront belched ash that coated the petunias in the yard, along with everything else.

Carlisle's late mother, Lilian Baker Carlisle, was an author, state representative and assistant to the founder of Shelburne Museum. She recognized the appeal of the working-class neighborhood where policemen, firefighters and mill workers knew each other well.

Carlisle's father died in 1994; her mother, in 2006. Her sister, Penelope, who lived in Connecticut, owned the house for years, and family members used it for vacations. After Penelope died in 2020, the home hit the market.

By then, Lakeview Terrace, which runs along an escarpment overlooking Burlington Bay, had changed. The Moran Plant had been decommissioned, and the street had become known for million-dollar views of Lake Champlain and the Adirondack Mountains. At its northern end, the Hartland Group, a development company cofounded by Burlington Mayor Miro Weinberger, had built a 25-unit apartment building. Neighborhood opposition to the Packard Lofts became a yearslong legal fight. At the opposite end of the street, Redstone had erected One Lakeview, a 43-unit apartment building cantilevered over the cliff.

At 107 Lakeview, Carlisle was intensely interested in what would become of her mother's old house. "I was hoping somebody would buy it who would be delighted to live here," she said, "and carry on the good memories and the happiness that we all experienced."

Instead, it's listed on Airbnb.

"Newly renovated, historic home with modern features and designs. Our home is located in downtown Burlington and features a wall of windows with spectacular lake and mountain views," the description reads. The price to rent the four-bedroom home: $442 a night.

Carlisle's mother had discovered 117 Lakeview by knocking on doors to see whether anybody wanted to sell. Today's real estate market is radically different. Detailed information — sales history, school districts, taxes, photographs — is readily available to home buyers, including both local and faraway investors.

McGowan, the Old North End landlord, has gotten plenty of unsolicited bids to buy his houses, often via postcards from investors. In some parts of the country, investors are using data to target desirable neighborhoods and buy out swaths of owner-occupied homes — then rent them out. While that hasn't become common in Vermont, homes are being increasingly purchased as commodities — places to park cash or generate monthly income.

Joe Ament, a University of Vermont-trained economist who is currently teaching in Leeds, England, got interested in the Burlington real estate market a few years ago, when he and his wife tried to buy a home and kept getting "outbid like crazy."

As he recounted recently on Vermont Public Radio's "Brave Little State" program, Ament obtained decades' worth of sales data to track how many homes in Burlington sold to an entity with "Inc.," "Corp." or "LLC" in its name. Just 2.7 percent of Queen City homes sold in 1999 met the criteria, he told Seven Days. By 2018, that figure had increased to 19 percent, or nearly one in five homes. The data doesn't tell Ament what the investors were up to — whether houses were bought to be rehabbed and flipped, rented long-term, turned into short-term rentals, or put to another use.

Nor does his method capture every home bought as an investment. Case in point: 117 Lakeview Terrace, the new Airbnb. Four local residents — Jake Perkinson, Catherine MacLachlan, and Sean and Fauna Hurley — bought the place in March 2021 for $870,000, records show.

Sean Hurley, who spoke to Seven Days on behalf of the owners, said they are friends who've worked together to renovate a house that had been unoccupied. He stressed that the effort involves local people working together. They've put in sweat equity but also hired a crew to update the place.

"It was a time capsule," he said. "There was a rotary phone on the wall."

Hurley said the income generated by short-term renters would fund longer-term plans to improve the house. He views the place as an investment in his family's future — something that might help pay for his two young children's college education.

Meantime, he said, the house is contributing to the local economy. "It's got people coming through it, and they're paying meals and rooms tax, and they're paying builders and cleaners," he said, noting that short-term rentals are a thriving mini-economy in Burlington.

At the same time the new owners decided to buy the Lakeview Terrace property, the Burlington City Council was considering ways to regulate such investments. On February 22, after years of discussion, the council voted to adopt an ordinance that would impose new restrictions on short-term rentals. Most notably, they would only be allowed in the "primary residence" of the host, with limited exceptions. Councilors cited the housing crisis as a reason for their action.

Weinberger, who has 21 days to decide whether to sign the proposed ordinance into law, has expressed skepticism, saying it "goes too far" and would have negative economic consequences for Burlington. He was still weighing a veto last week.

Carlisle has written and spoken to the council in favor of restrictions. She's not against Airbnb-style rentals, she said in an interview, if they are in owner-occupied homes. A few of those have operated in the neighborhood, she said, and she understands that people need help paying their taxes and expenses. What upsets her, she said, is when houses are no longer available to families.

"Who wanted that house?" she asked rhetorically, about 117 Lakeview Terrace. "Who wanted that home? Who wanted to make memories? Who wanted to live there?"

Sean Hurley, for one, according to Hurley. Moving in has always been a possible part of the plan, he said. Turning the house into his primary residence is an option, he said; he, Fauna and their two children might move in. If they do, he said, he believed that they would still be able to rent the house short-term for part of the year. He said he was still looking for "clarity" on the city ordinance.

"We're just two streets away, so it's easy for us to stay close to it," said Hurley, who lives on Drew Street. "When we think about the owner-occupied or not owner-occupied, those seem like things that our family can satisfy according to the letter of the ordinance."

'I Love the Smell of Woodsmoke'

For now, the housing market shows no sign of easing anywhere in Vermont.

On February 20, house hunters parked more than a dozen vehicles bumper-to-bumper along the snowy shoulder of Jericho Street in Hartford, where the White and Connecticut rivers meet. They'd been drawn to a home with four bedrooms and two and a half bathrooms on seven acres of mostly wooded land. None had been deterred by the list price — $499,000 —which was well above the $290,000 the house had fetched in 2016, according to Zillow.

As they toured the house, the would-be buyers could see they had plenty of competition.

"I love the smell of woodsmoke," one woman said as she strolled up the drive, passing others who were walking out. Inside, people left their shoes by the front door and padded along the hardwood floors. A blaze in a glass-enclosed fireplace with an imposing stone mantel cheered the living room. Around each corner, a couple or family was poking around. One woman on a video chat aimed her phone's camera around each room for a remote viewer and described her impressions.

Aric and Abby Mazick, who talked to Seven Days in the driveway as they headed back to their car, have become accustomed to these scenes. The previous day, Aric said, the couple headed to an open house in Woodstock that began at 10 a.m. They heard that three offers had been made by 11 a.m.

The couple moved to the Upper Valley last summer after selling their home in Florida, Aric said, yearning "to be in the mountains, somewhere a bit less populated — somewhere a bit more quiet and local and deliberate in that way of life." They've been renting but hope to buy. Aric grew up in Massachusetts and used to vacation in Vermont.

He works from home, and Abby has a job with a pediatric dentist in nearby Norwich. The house seemed like a decent property, compared with others in the region, Aric said. Abby liked the location. "The price point is pretty good," she said.

They planned to talk over whether to make an offer.

Eric Benson, just a few steps behind them, wasn't shopping for a house for himself. He was with his wife, Sarah Markus, the woman who had been giving a running commentary to somebody on a video chat. That somebody, it turned out, was Benson's brother in Seattle.

Benson explained: His brother and sister-in-law were looking for a place to buy. Prices in Seattle are quite high, and they were thinking about moving to Vermont to be closer to family.

What did his brother think of this house?

"It's hard to tell from so far away, but I got a sense of excitement from him," Benson said.

Benson and his wife are themselves relative newcomers to Vermont. They sold their home outside Denver and moved last summer. Benson is a lawyer and is working remotely. His wife, a physician, recently landed a job in the emergency department at Dartmouth-Hitchcock medical center in Lebanon, N.H.

The move brought them closer to family in Thetford. Both were undergrads at Dartmouth College and love the area.

They bought a place in Hartford. It's bigger than their house in Colorado, which was on a quarter-acre lot, and came with 28 acres of land. But while it has "a hundred times" the land of their Denver property, Benson said, it didn't cost much more.

"It seems like a great bargain," Benson said. "But my understanding is, relative to usual, prices are quite high."

Two weeks later, the house on Jericho Road was no longer listed on Zillow. Real estate agent Susan Cole, whose firm represents the seller, said it was under contract.

There’s no indication that Vermont’s red-hot market is cooling, according to Mannix, the real estate agent with the Malley Group. He said his firm is representing the owner of a 1,064-square-foot condominium in Essex Junction. Asking price: $238,000

"I just listed this yesterday," he said last week, "and we have 27 showings and three offers sight unseen so far."

Seven Days is examining Vermont's housing crisis — and what can be done about it — in our Locked Out series this year. Send tips to [email protected]. These stories are supported by a grant from the nonprofit Journalism Funding Partners, which leverages philanthropy and fundraising to boost local reporting.

Seven Days is examining Vermont's housing crisis — and what can be done about it — in our Locked Out series this year. Send tips to [email protected]. These stories are supported by a grant from the nonprofit Journalism Funding Partners, which leverages philanthropy and fundraising to boost local reporting.

Got something to say?

Send a letter to the editor

and we'll publish your feedback in print!

About The Author

Matthew Roy

Bio:

News editor Matthew Roy has been at Seven Days since 2014. Before that, he was an editor at The Virginian-Pilot.

News editor Matthew Roy has been at Seven Days since 2014. Before that, he was an editor at The Virginian-Pilot.

More By This Author

Latest in Category

Speaking of...

-

Barre to Sell Two Parking Lots for $1 to Housing Developer

Apr 22, 2024 -

Ethics Panel Dismisses Complaint Against Ram Hinsdale

Apr 11, 2024 -

Another Round of Motel Evictions Sparks Confusion, Frustration and a Rush to Erect Temporary Shelters

Mar 19, 2024 -

Burlington Considers Zoning Changes to Encourage More Home Building

Mar 6, 2024 -

A Pandemic-Era Program That Created and Rehabbed Hundreds of Apartments Will Be Extended

Feb 28, 2024 - More »

find, follow, fan us: