Published March 31, 2015 at 10:00 a.m. | Updated April 4, 2022 at 8:00 p.m.

Our kids need to get smart about money. From an early age, they're bombarded by messages from savvy marketers eager to sell them snacks, toys, apps and clothes. In their teen years, they'll have to make an informed decision about something much pricier: a college education.

Who better to teach kids about money than their parents? But talking about finances isn't always easy. Some parents I know avoid the topic, maybe because they want to protect their kids from it, or because it makes them uncomfortable — either about having a lot of money or not having enough. Sometimes it can be hard to know how to start the conversation.

I don't mind discussing money with my kids. I'm fascinated by the ways in which monetary decisions — ours and those of others — can affect our lives. I want my 9-year-old son, Graham, and 6-year-old daughter, Ivy, to appreciate that, too, so I'm always looking for engaging financial literacy lessons for them.

I saw an opportunity one Saturday morning in February, when I dragged them with me to pick up a prescription refill for my multiple sclerosis medication. I'm no financial expert — I majored in English, not economics — but I know a good hook when I see one.

My medication isn't available from the drugstore down the street; we had to drive to the University of Vermont Medical Center pharmacy to get it. When we got up to the counter, the pharmacist handed me three small, lightweight, white boxes. Each was about the size of a brick, and held 12 syringes full of the drug that keeps my MS at bay. I've been taking it three times a week for nearly a decade, so these boxes are a familiar sight at our house.

Once we were out in the parking lot, I held up the clear plastic bag containing the boxes. "How much do you think this medicine costs?" I asked.

"Ten dollars?" they guessed. "One hundred dollars?"

"Let me give you a hint," I said. "This three-month supply costs more than we paid for this car."

That got their attention.

In rapid-fire succession, they responded "A thousand dollars? Two thousand? Ten thousand?"

"More," I said, adding that $10,000 was about what we paid for our car when we bought it used two years ago.

In fact, that bag of medication costs more than $15,000. They gaped at me, stunned; Graham did the math. "That's $60,000 a year!" he exclaimed.

It's truly an eye-popping number, and when they're older, I'm sure it will spawn yet another conversation about medical research and drug companies. But that wasn't my focus that day.

Shifting gears, I asked, "How much do you think we pay for my shots?"

"Ten thousand dollars? A thousand dollars?"

"Nope," I said. "We pay $50 for a three-month supply."

More incredulous stares.

"Do you know why we don't pay full price?" I continued. They didn't. "Because we have health insurance."

I explained how health insurance works: We pay a premium every month even if we don't go to the doctor. But if we do go to the doctor, the insurance covers most of the cost; the same is true of prescriptions. It might seem unnecessary when you're healthy, but you never know when you might get sick and need it. We use the money we save to pay for things such as food, clothes and vacations.

"And that's why it's so important to have health insurance," I concluded. They agreed. It's hard to argue with that logic.

I don't remember having conversations like these with my parents when I was growing up. Like most families I knew, mine didn't discuss finances. My sister and I had no idea how much our house or cars were worth, what health insurance cost, or how much money our parents made. They said it was none of our business. These days, of course, my kids could approximate all of that data in minutes using Google.

My partner, Ann-Elise, and I would rather they hear it from us. We're not the only parents who feel this way, at least according to New York Times personal finance columnist Ron Lieber.

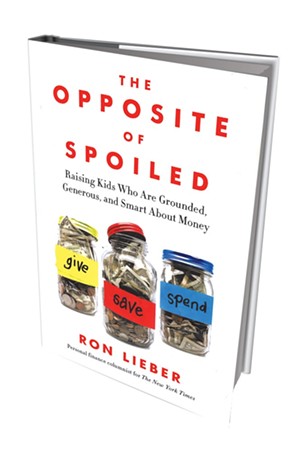

In February, Lieber published The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous and Smart About Money. He interviewed financial experts, sociologists, psychologists and lots of parents to find out how to raise kids who appreciate the value of a dollar. He describes the book as "a generational manifesto first and foremost — a promise to our kids that we will make them better at managing money than we are and give them the tools they need to avoid the financial traps that still ensnare so many adults."

I bought it and finished it in three days; I'd recommend it to anyone interested in the topic. Not all of it will be relevant to all readers — Lieber is clearly writing for an affluent, New York Times-reading audience — but he's an engaging writer, and he compiles some useful tips and real-life examples.

The most dramatic of these became the lead anecdote in a January 29 New York Times piece adapted from his book, headlined "Why You Should Tell Your Children How Much You Make." Lieber interviewed Scott Parker, a man who went to the bank and pulled out his entire monthly salary in $1 dollar bills. He brought the bag of money home where he, his wife and their six kids separated it into piles representing taxes, tithing to their church, their house payment, dinners out, and sports and activities.

"That night, the lessons couldn't have been clearer," writes Lieber. "The family's life was expensive. Every decision mattered. Savings and faith were high priorities. And there wasn't much left at the end of the month."

Parker's oldest son, who was 15 at the time, recalls it clearly two decades later and plans to repeat the exercise with his own kids.

It's the kind of activity I plan to try with mine when they're a little older. So many financial transactions are invisible these days — we deposit our paychecks automatically, we use credit cards at stores, we type a string of numbers into the computer to buy things online. I want my kids to understand the connection between the work we do and the money our family can spend. And I want to show them our budget — and how we came up with it. They'll have to create their own soon enough.

Hopefully they'll be able to learn from these conversations. A month after I brought the kids to the pharmacy, I asked Graham if he remembered how much my medication cost.

"Fifteen thousand dollars for a three-month supply," he replied. "But we don't have to pay all of that because we have health insurance." That knowledge will come in handy when it's time for him to sign up for it himself.

Kids & Cash

Want to help your kids learn about money? Here are some tips from Ron Lieber's book The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous and Smart About Money, and from other sources I've found useful. I'd love to hear about yours, too. Send them to me at [email protected].

Don't lie about money. When kids ask for a new toy at the grocery store, it's tempting to brush them off with lines like, "I don't have any money," or "We can't afford it," even if the item is something that's affordable for you. In his book, Lieber cautions against these little lies.

He cites clinical psychologist James Fogarty, who says, "The hidden message of offering the truth to children is that you and your children can work together to manage difficult issues. Children also learn that if they ever need a straight story, they can count on you."

I usually tell my kids, "Next time, you should remember to bring your own money so you can buy it."

Give details only as needed. Even very young kids are curious about money. They notice when their friends have more or fancier things than they do. That prompts all kinds of uncomfortable questions, like, "Are we rich?" or "Are we poor?" Rather than answering them directly, Lieber recommends responding with another question: "Why do you ask?" That will give you time to formulate a response, and will help you understand what they're really asking and why.

And though Lieber urges parents to let kids know how much they make, he recommends waiting until they're ready to handle this sensitive information. They need to be mature enough to understand that it's confidential. "You can begin to initiate them when they're as young as 5 or 6," he writes, "building their knowledge slowly and giving them the real answer while they're still teenagers."

Talk about your spending decisions. As Lieber notes, "Every conversation about money is a conversation about values." Next time you're clipping coupons or buying fair-trade coffee, or writing a check to your favorite charity, ask your kids if they know why you're doing what you're doing, and explain it to them. It's a chance to help them understand the values that drive your decisions.

My kids and I have had lots of conversations about the differences between banks and credit unions, why we shop in locally owned stores and why we buy from businesses that advertise in Kids VT and Seven Days (because they make it possible to provide journalism, which is essential to a functioning democracy, and because they pay my salary).

Give an allowance. Most money experts recommend that parents give kids an allowance, though they debate whether it should be given freely or tied to chores. There are also varying theories about the amount. Lieber recommends starting by the time kids are in first grade and giving between $.50 to $1 a week for every year of the child's age.

That's essentially what we do at my house. Our 6-year-old gets $6 a week; our 9-year-old gets $9. It's not tied directly to chores. They get to keep one half for spending money, and one half goes into a savings account at Opportunities Credit Union. If the kids deposit money there every month, the credit union gives them two free movie tickets at the end of the quarter. Many financial institutions have similar programs for young savers.

Lieber recommends splitting the allowance into thirds, with one third going to spending money, one third to the bank, and another third to charitable giving. He suggests letting kids pick the charity and having them deliver the money in person.

He also recommends giving middle school children their entire clothing budget to manage themselves. "This may seem risky, given how many opportunities there are to make bad choices," he writes, "but it's a powerful experience."

Parents who choose that route should resist the urge to bail the kids out when they make mistakes. Buyer's remorse is an important learning tool.

Think of stores as a classroom. It's much easier to do the grocery shopping when you leave the kids at home, but bringing them along can provide teachable moments. There's a good summary of how to use the grocery store as a classroom at themint.org, a financial literacy website run by Northwestern Mutual. Tips include: Read the labels to check the ingredients, talk about the differences between store brands and name brands, make a list and emphasize the importance of planning, and set limits on what you can buy. This helps kids understand the difference between wants and needs, and illustrates the necessity of trade-offs.

My kids are old enough now that I can ask them to find grocery items on their own and bring them to me. Sometimes I give them a mathematical challenge and ask them to use the price per unit to figure out which of two items is the better deal.

Lately, when I've had just a few things to buy, I'll give the kids some cash and send them in to shop on their own. I may not tell them exactly which brand to buy, or how much, so they have to figure out what they can get for the money. If they can't find something, they ask a clerk for help. At their age, that's still a fun adventure.

Sometimes they surprise me, though. Last October, I sent them into Shaw's with $10 to buy eggs and rice milk. Instead of getting the free-range eggs, they bought the cheap kind and used the savings to buy a bag of small plastic skulls that we could use as a Halloween decoration.

"I thought it would be cheaper for us than getting a whole skeleton," Graham reasoned. I let him keep them.

Resources:

moneyasyougrow.org: an initiative of the President's Advisory Council on Financial Capability

usa.talkwithourkidsaboutmoney.com: activities that promote Talk With Our Kids About Money day, the last Wednesday in April

vermonttreasurer.gov/financial-literacy: Vermont's official financial literacy website

This article was originally published in Seven Days' monthly parenting magazine, Kids VT.

More By This Author

Speaking of KidsVT - Features,

-

Back to School During Delta: A Pediatrician With Young Children Offers a Road Map — and Survival Strategies

Aug 24, 2021 -

Can You Dig It? Make Your Own Worm Farm With These Simple Steps

Aug 24, 2021 -

Mr. Fix-It: Marty Spaulding Works Behind the Scenes to Help Students Learn on Campus

Aug 24, 2021 -

How to Savor Vermont's Shortest, Sweetest Season

Jun 29, 2021 -

Good Citizens Rocked the At-Home Challenge

Apr 6, 2021 - More »

Comments

Comments are closed.

From 2014-2020, Seven Days allowed readers to comment on all stories posted on our website. While we've appreciated the suggestions and insights, right now Seven Days is prioritizing our core mission — producing high-quality, responsible local journalism — over moderating online debates between readers.

To criticize, correct or praise our reporting, please send us a letter to the editor or send us a tip. We’ll check it out and report the results.

Online comments may return when we have better tech tools for managing them. Thanks for reading.